National Insurance Rise Calculator

More than 45000 NI rate is 2 of your income. This calculator has been updated for the 2021-22 tax year.

:max_bytes(150000):strip_icc()/dotdash_Final_Okuns_Law_Economic_Growth_and_Unemployment_Oct_2020-01-2e5dd7aa7c194e14a82707b84b00d1a3.jpg)

Okun S Law Economic Growth And Unemployment

The governments new plans have everyone paying an additional one percent on their national insurance - meaning a rise from the current 12 and 2 to 13 and 3 employees or from 9 and 2 to 10 and 3 self employed.

National insurance rise calculator. A manifesto-busting 1p increase in national insurance contributions for workers and employers could be used for a. The National Insurance Scheme NIS is a compulsory contributory funded social security scheme covering all employed persons in Jamaica. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage.

The prime minister is expected to announce a rise in national insurance payments to fund social care despite this being a breach of the 2019 Tory manifesto. Tax and NI Calculator for 202122 Tax Year. But raising national insurance is a terrible way to go about it.

To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to. Calculate the company car tax charge based on a. 184 to 967 a week 797 to 4189 a month 12.

Enter your Salary and click Calculate to see how much Tax youll need to Pay. Had a Pay Rise. National Insurance Calculation Example for the Employed.

Between 8164 - 45000 NI rate is 12 of your income. The chancellor has stated that any tax rise to pay for care has to be accompanied by new policy on care costs with the. First published on Thu 2 Sep 2021 1444 EDT.

The pay rise calculator part of our free UK Payroll Suite has been updated for the 202122 tax year if you would like to review your pay rise for previous tax years please change the tax year in the advanced tax calculator options. It asks younger and lower paid workers to contribute more than older and wealthier people compared to a fairer rise in income tax. National Insurance Rates for the Employed.

Class 1 National Insurance rate. Income Tax NI Calculator. You can use our calculator below to work out how your NI contributions will be in the current tax year.

Technically this does not break the Governments election pledge made four times in the Conservative Party Manifesto 2015 that we will not raise VAT National. You will need to pay Class 2 NI worth 159. One MP said the plan appeared to be protecting the inheritances of.

You will also have to pay 3549 9 on your income between 9568 and 49000. The results are broken down into yearly monthly weekly daily and hourly wages. Youll pay less if.

Alternatively to find out how your bill is calculated see our guide to National Insurance rates. The calculator then provides monthly PAYE and NI deductions and an annual figure overview of deductions so you can review monthly amounts and annual averages for standard payroll deductions. If your income is less than 8164 you are exempted from National Insurance contributions.

Youre a married woman or widow with a valid. Request form for PAYE CHAPS transfer. The Daily Telegraph reports that Downing Street favours a 1 rise in the national insurance rate affecting about 25 million workers and self.

PMs national insurance rise plan criticised as tax on young workers to protect the homes of older people. Use the Tax year dropdown to see how much youll get from 6 April 2021. Over 967 a week 4189 a month 2.

The lower the earnings the bigger the percentage rise. National Insurance contributions will be going up by an average of 15 for around six million people in April. 8164 or below - NI Exempt.

It is important to understand that National Insurance is calculated on. It is administered under the National Insurance Act and offers some financial protection to the worker and his or her family against loss of income arising from injury on the job sickness retirement andor death of the bread winner. This Tax and NI Calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 202122.

Increasing national insurance by 1p for employees and the self-employed would raise around 6bn a year according to calculations by the Resolution Foundation. You pay no NI contributions on the first 9568 that you make. Tools to help you run your payroll.

Wondering how much that pay rise will mean in real terms after tax PAYE and National Insurance Deductions. Congratulations thats great news.

How To Calculate Inflation Rate Forbes Advisor

Budget 2020 Richer Or Poorer Ask The Calculator Bbc News

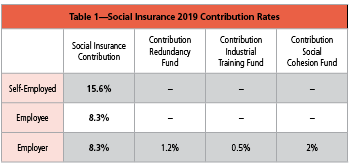

What You Need To Know About Payroll In Cyprus

How To Read Your Payslip National Insurance Royal London

Budget 2020 Richer Or Poorer Ask The Calculator Bbc News

Enu2hbim7hqzhm

88 Lenvzw3tx1m

Annual Salary Sacrifice Calculator 2021 22 Tax Calculator

Consumer Price Index Cpi Definition How To Calculate And Uses

/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Visualisation Of Salary Deductions The Salary Calculator

Government Scraps National Insurance Tax Cut For Uk Self Employed

Ctagnb5nyqopbm

Pay Rise Calculator Compare Salary For 2021 22 To 2020 21

How To Read Your Payslip National Insurance Royal London

Social Insurance Connecting Theory To Data Sciencedirect

Calculating Social Security Benefits A Hypothetical Example Of A Higher Download Table

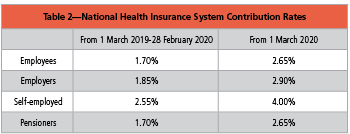

What You Need To Know About Payroll In Cyprus

National Health Insurance Premium Calculator Chart 2021